The Illusion of Perfect Timing: Why Waiting to Buy Might Cost You More Than You Think

In the rollercoaster ride of real estate, it’s easy to fall into the trap of waiting for the perfect moment to buy a home. When interest rates climb, it’s tempting to hold off, fearing you’ll be throwing away money. Conversely, when rates dip and housing prices soar, it’s natural to feel overwhelmed and opt to wait until the market settles. But here’s the truth from someone who’s been in the game for nearly three decades: there’s no such thing as the perfect time to buy.

Let’s address the common sentiments:

“Rates are too high – It’s like throwing away money! I’ll keep renting until the market adjusts.”

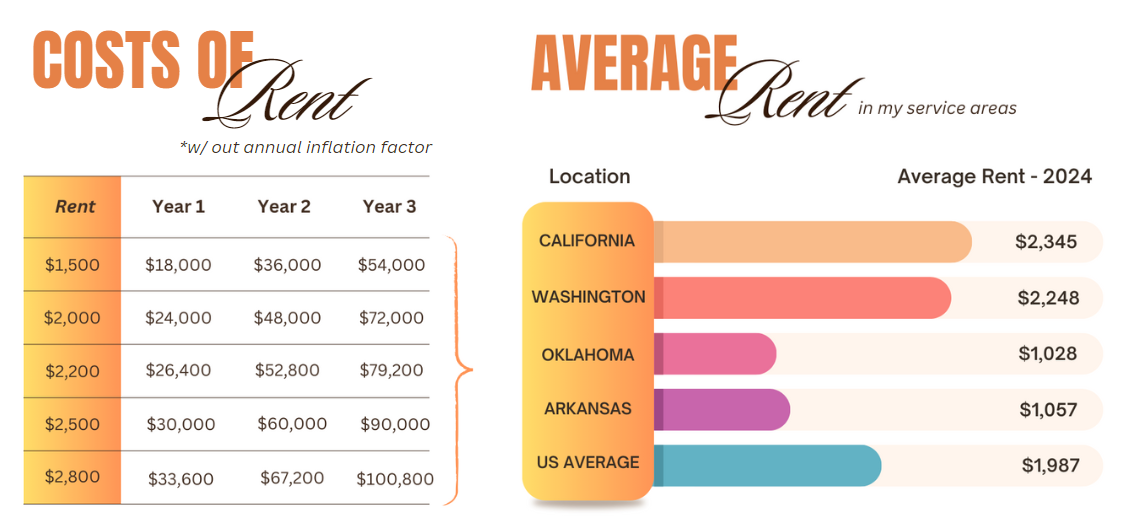

Yes, when rates are up, it might seem like you’re bleeding money by committing to a mortgage. But consider this: every month you pay rent, you’re essentially contributing to your landlord’s mortgage. That money doesn’t come back to you, nor does it build towards an asset that you can call your own. It’s gone, vanished into thin air. Renting might provide temporary relief, but it won’t lead to long-term wealth accumulation.

“Omg housing prices are insane right now! My neighbor’s house sold for $60k over the listing price! I’m going to wait until the market calms down.”

When housing prices skyrocket, it’s easy to feel intimidated and opt to wait until the frenzy subsides. However, waiting for the market to “calm down” is like waiting for a storm to pass in a perpetually stormy climate. Real estate markets ebb and flow, but they rarely stabilize to a point where everyone agrees it’s the perfect time to buy. Meanwhile, you’re missing out on potential equity growth and the benefits of homeownership.

So, what’s the solution?

Consider the long game: Real estate is not just an investment; it’s a place you call home. Unlike stocks or bonds, where you’re at the mercy of market fluctuations, with real estate, you have a say in its destiny. You can make improvements, infuse it with personality, and watch it appreciate over time while meeting your fundamental need for shelter.

You might qualify sooner than you think: Many renters underestimate their ability to qualify for a mortgage. If you’re already paying rent, chances are you meet some of the criteria lenders look for – stable income and good credit. Your first home might not be your dream home, but it’s a stepping stone towards building equity and financial security.

Stop throwing away money: Every month you spend renting is money that could be going towards building equity in your own home. Instead of padding your landlord’s pockets, why not invest in your future and nurture an asset that grows alongside you?

In conclusion, waiting for the stars to align in the real estate market might lead to missed opportunities and years spent on the rental treadmill. As a mortgage broker who has seen it all, I urge you to consider taking the leap into homeownership. There may never be a perfect time, but there’s always a right time to start building your future. Don’t let the illusion of perfect timing hold you back from achieving your homeownership dreams.

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2023 | NEXA Mortgage LLC.

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2023 | NEXA Mortgage LLC.