The Home Buyer’s Financial Checklist: Budgeting Beyond the Down Payment

Buying a home is an exciting milestone, and sometimes we can get caught up in that excitement and begin shopping before we’re truly ready. Sadly, I sometimes see buyers getting blindsided by some of the upfront costs associated with house shopping, leading to a rocky start to the buying process. Along with getting a rock solid pre-approval by your trusty mortgage professional 😉 it’s also important to review your financial checklist. Let’s take a moment to dive into some of the costs that we commonly see arise during the buying process and how to prepare… because although we all may like surprises, we don’t like them during a real estate transaction.

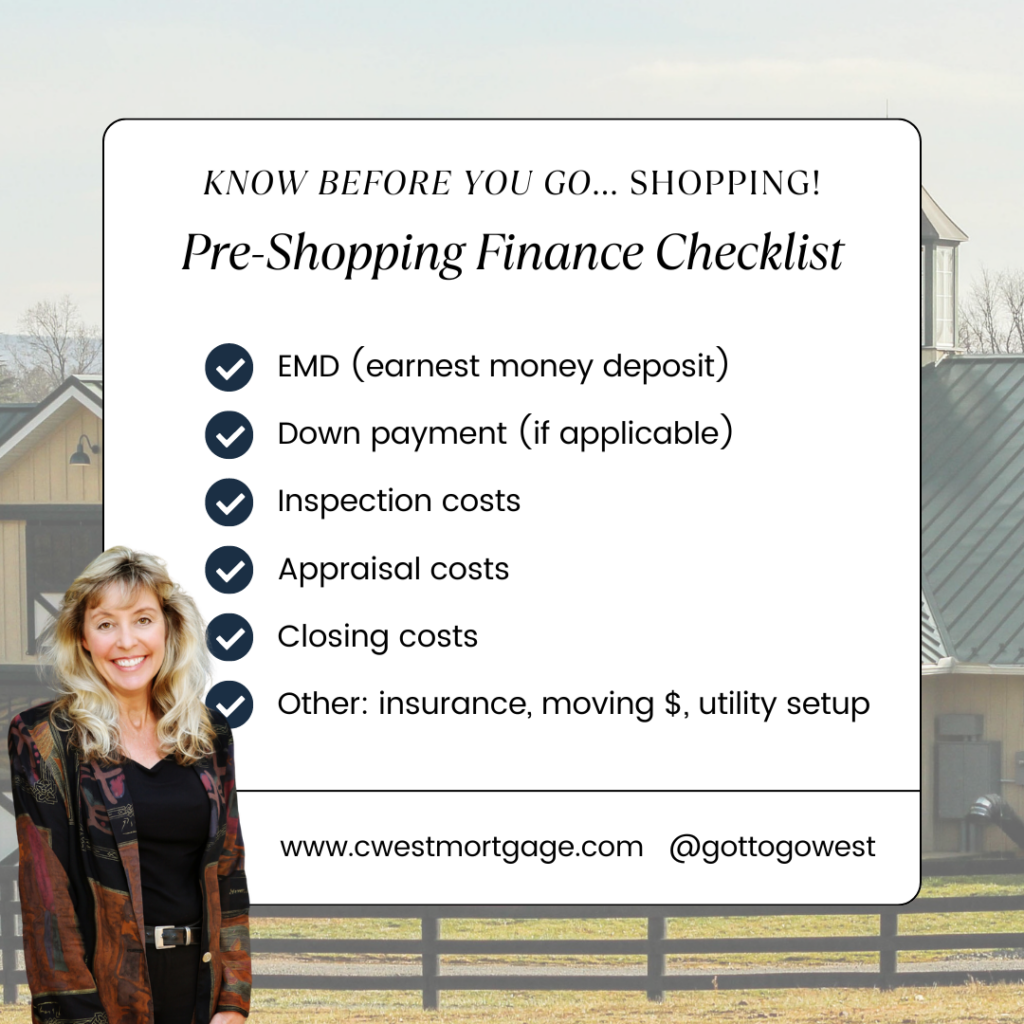

Let’s break it down:

- Earnest Money Deposit (EMD): When you make an offer on a home, you’ll typically need to provide an EMD, which is a good-faith deposit to show you’re serious about the purchase. The amount can vary, but it’s usually around 1-2% of the purchase price.

- Down Payment: Depending on the loan program you choose, you may need to put down a certain percentage of the home’s purchase price. For example, conventional loans often require a down payment of at least 3-3.5%. However, some programs like FHA, USDA, or VA loans allow for a lower down payment, or even no down payment at all.

- Inspection Costs: Before finalizing the purchase, it’s crucial to have the home inspected by professionals. This can include a general home inspection, pest inspection, and potentially specialized inspections like a roof or foundation inspection. Expect to budget a few hundred dollars for these inspections. If the home is being renovated, is undergoing necessary repairs, or is a new construction, there may also be a need for a “final inspection” to ensure that all the promised work has been completed. Final inspection fees may range in price, but are typically around a couple hundred dollars.

- Appraisal Fee: Your lender will require an appraisal to ensure the home’s value matches the agreed-upon purchase price. Appraisal fees can range from $500 to $850, depending on the home’s size and location.

- Closing Costs: These are the fees associated with finalizing the home purchase, and they can add up quickly. Closing costs typically include items like:

- Lender fees (origination, underwriting, etc.)

- Title fees (title search, title insurance, etc.)

- Prepaid costs (property taxes, homeowner’s insurance, etc.)

- Other miscellaneous fees (recording fees, notary, transfer taxes, etc.)

In general, closing costs can range from 2-5% of the home’s purchase price.

- Other Potential Costs:

- Moving expenses

- Furniture and appliances (if not included in the purchase)

- Utility setup fees

Remember, these costs are just estimates, and your actual expenses may vary. As a mortgage broker, I’m here to guide you through the process and help you understand and plan for these expenses.

Buying a home is a significant investment, but with proper preparation and budgeting, it can be a smooth and enjoyable experience. Don’t hesitate to reach out if you have any questions or need assistance along the way.

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2023 | NEXA Mortgage LLC.

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2023 | NEXA Mortgage LLC.